Market Pullback Might Signal Roller Coaster Ahead

Does This Week’s Market Pullback Signal Roller Coaster Ahead?

- Stocks experienced a broad market pullback for the first time in 2018

- One chart that might suggest this is a pause, not a sustained correction

- Why we remain cautiously (but not all-out) optimistic on (select) risk assets

This week’s decline in the S&P 500 would be the first time it has fallen in 2018. As of Friday, February 2, the index had a market pullback of -3.2% from last Friday’s close.

Why did markets correct?

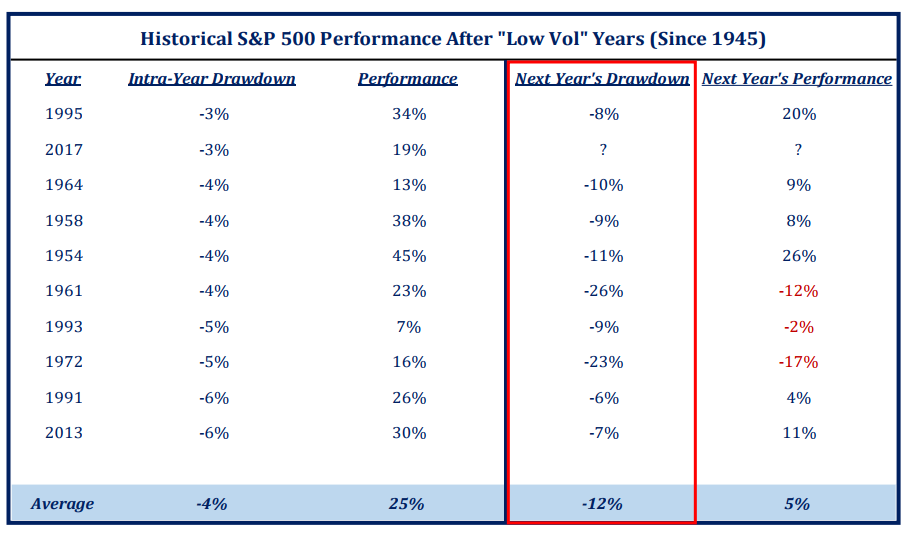

- We were due for a market pullback following an unprecedented run in the market over the last year. As research house Strategas cites, strong years with low volatility might often presage higher volatility in the following year. A market pullback, also known as a “drawdown”, is defined as a decline from market peak to trough of -6% or more. Such market pullbacks are common even in bull markets. However, 6 of 9 such years still resulted in market gains for the year, albeit less dramatic than the year before.

- Good economic news is a mixed bag for the markets (and can spur a market pullback). For example, the January jobs report showed decent jobs growth, lower unemployment, and an uptick in wages. Market players got spooked that the Federal Reserve would hike rates further and risk slowing the economy too much. Recent strong market gains in January also have left valuations high, even though the strong economy generally has resulted in a positive 4q earnings report season.

Recent history over the last 25 years suggests future market gains might slow and the chance for a market pullback can rise. Yet, the level of interest rates themselves might not derail the market in and of themselves.

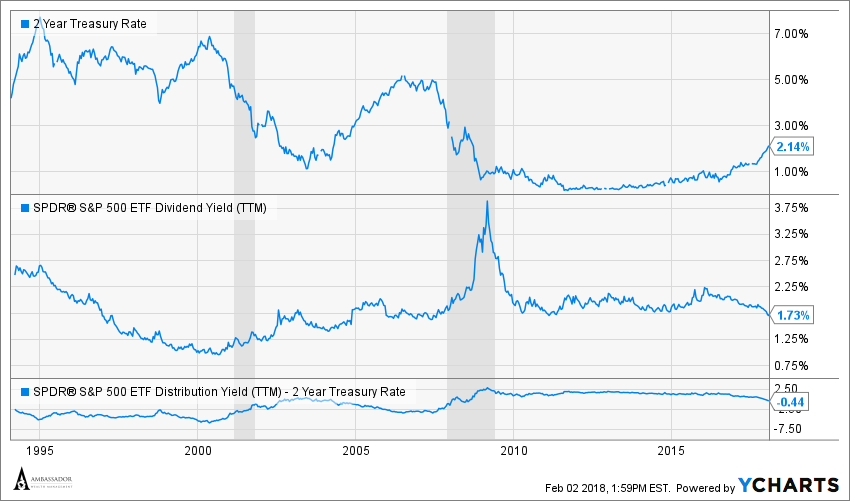

The chart below shows that the yield on 2-Year Treasury Bills now exceeds the dividend yield on the S&P 500 for the first time in nearly a decade (post 2008, the Great Recession or Global Financial Crisis). However, taken over a longer timeframe, 2-Year Treasury yields have actually been much higher both in absolute terms and even relative to the dividend yield of the S&P 500. Given what we know about the current environment, a further rise in the 2-Year Treasury from current levels of 2.1% to say 3.0% might not necessarily pressure that of the S&P (at least based on history from the economic expansions earlier in the mid 2000’s and mid 1990’s).

The one signal we would be wary of is signs of economic recession (gray shaded areas in the graphs). If history were to repeat, that might portend a market pullback of greater magnitude. For reasons that will be discussed in a future blog, we believe recession is unlikely in the near term.

- We remain cautiously optimistic on select risk assets in 2018 after the market pullback. As we discussed in our 2018 Investment Outlook, economic fundamentals are constructive (not only in the US), but valuation is full to excessive in many areas.

Some market pundits are more bullish:

“A market surge is ahead. If you’re holding cash, you’re going to feel pretty stupid.” Ray Dalio[i]

“I recognize that we are currently showing signs of entering the melt-up phase of the bull market.” Jeremy Grantham[ii]

“The game of economic miracles is in its early innings. The world is getting better.” Warren Buffett[iii]

What we like:

- Cautiously optimistic on equities (still cheaper than fixed income)

- Broader exposure beyond S&P (Japan, small cap, small portion of emerging markets)

- Liquid absolute return strategies less correlated to equities or fixed income (call writing)

What we dislike:

- Much of fixed income (duration, most credit expensive)

- Europe

- Many illiquid “alternative” strategies

Learn about our 2018 market outlook for different investments that we use to build client portfolios, keeping market pullback in mind.