Views on Fixed Income: Stocks, Bonds, and Inflation (Part Two)

- Bond yields are even lower when adjusting for inflation

- Even if bonds decline due to higher interest rates, stocks in many cases can still rise.

- Investors need diversification regardless.

Bond yields are not simply priced in a vacuum.

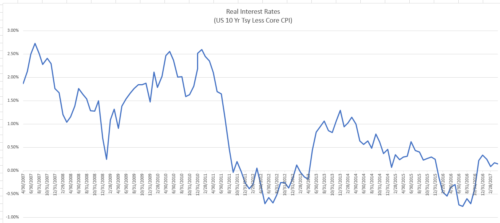

Investors (usually) expect to collect some sort of coupon above the rate of inflation. They want to protect their purchasing power. However, as the chart below reveals, at times bond yields can fall below the rate of consumer price inflation. Indeed, 10-year bond yields were actually below the rate of inflation until just before President Trump’s election.

Inflation is stable to increasing.

If we get economic stimulus and greater confidence on prospects for future economic growth, bond yields could rise. When bond yields rise, bond investors suffer a loss on their principal. Markets force the bonds to price at higher yields.

What happens if bond yields increase significantly in real purchasing power terms? What if they were to rise 1% or 2%? How could that impact returns on other investments such as stocks?

History over the last 55 years suggests that stocks in many, but not all, cases have posted positive annual returns when real bond yields have risen 1% or even 2% in the past year. In other words, bond investments have tended to lose money, yet stocks in many cases were able to increase.

Over the last 55 years, stocks, as measured by the S&P 500, fared well even when real 10-year bond yields increased by 1% or more. In fact, stocks appreciated more frequently and at higher rates under a moderate rise in interest rates.

Stocks still posted positive annual gains in most months when real bond yields rose an even more dramatic 2%. However, stock returns on larger increases of 2% or more in real interest rates were muted and occurred less frequently than when interest rates rose less dramatically.

In other words, in a scenario of rising real bond yields, bond investors potentially have more to be concerned about than stock investors. That does not imply, though, that stocks will necessarily do so well in the future, nor should investors discard all of their bond investments. What it might suggest, though, is that investors should consider investing in diversified portfolios that include an appropriate mix of different investments.