Client Newsletter 2Q24

Dear Ambassador Family,

As the vibrant spirit of spring blooms around us, we’re thrilled to reconnect with you in this quarter’s newsletter!

Investment Update: Enhancing Your Diversification

Just because the S&P 500 is close to all-time highs does not mean everything else is.

We remain concerned about inflation, interest rates, and market valuations.

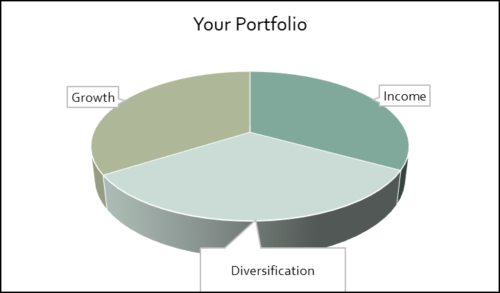

To be cautious does not mean we are passive. We have made some additions to your investments in liquid alternatives as well as commodities (what we call “diversified sleeve”). These investments potentially offer opportunity for principal growth and diversification outside of traditional stocks (“growth sleeve”) and bonds (“income sleeve”).

Depending on your account’s risk/return profile, you might have exposure to some or all of these liquid alternative investments (daily pricing, and in all but one case, daily liquidity):

- Equity long/short fund that takes limited exposure to direction of stock markets. This fund seeks to make returns on buying cheap companies with strong market positions and cash flows and hedging by selling shares in overvalued companies with deteriorating balance sheets. Returns can be volatile, particularly in markets that lack trend or narrowly-focused rallies. Longer term, the fund has had a positive long-term track record due to strong stock selection despite various headwinds (growth stocks outperforming value, momentum stocks continuing to be bid up beyond fundamentals).

- Corporate event driven fund that consists of 2 strategies: (1) merger arbitrage, the majority of the fund, seeks to profit from the completion of announced corporate mergers and acquisitions, typically by going long the acquisition target selling at a discount to the announced price and shorting the stock of the acquiror, which nets to limited exposure on absolute direction of stock markets, and (2) special situations, the minority of the fund, seeks to profit on idiosyncratic opportunities. Examples might include buying/selling options around investor days, special dividends, and other situations. Taxable clients have the potential to benefit from limited capital gains distributions as this fund was inherited from a previous manager’s strategy that generated meaningful tax loss carryforwards. While this is a lower volatility strategy than other of your investments, principal can go down if certain deals break up or trades in the event driven strategy do not work out.

- Late state venture capital fund that invests in private companies with sales of over $100mn and potentially further rapid growth. This space has lagged public markets since the peak of the venture capital bubble in 2021, yet the companies in the portfolio have continued to grow, in some cases turning profits, and secondary market liquidity has also increased, providing more transparency for valuations. Future catalysts for appreciation might come from a rise in mergers and acquisitions (larger public companies or other funds buying the fund’s underlying companies), further financing rounds for future growth, and IPO’s into the public market. Investors with longer time horizons (years) potentially benefit from the only public vehicle with a daily NAV. Risks include economy and specific risks to any of the fund’s nearly 100 company investments. The fund also has limited windows for redemption. (Accordingly, it is a modest allocation to portfolios with more aggressive risk appetites.)

- We have also begun a position in a managed futures fund that invests across multiple asset classes based on technical price factors. Times of macroeconomic and political uncertainty, including trending inflation and interest rates, potentially might offer bouts of volatility to traditional asset classes, but they might also provide opportunity for managed futures managers to shine. Managed futures managers take positions long or short on equities, bonds, commodities, and interest rates depending upon their views of price and other technical trends in the markets. Low volatility driven by low inflation and interest rates was a significant drag on performance for many funds in the last decade, but we believe the times might be shifting in favor of managed futures. Our specific manager invests in an index meant to replicate the returns of some of the world’s leading managed futures managers.

- Additionally, we have maintained meaningful exposure to commodities (precious metals, broad based commodities including energy, agriculture, metals). Recently, we have added small positions to cryptocurrency and gold miners. These all potentially benefit from rising government debt, uncertainty in inflation and interest rates, and geopolitical risk as well as loss of confidence in the US Dollar globally. Supply shortages in certain commodities offer a further potential catalyst. The main risk would come if the US Dollar regained credibility at the expense of alternative currencies.

Considering a Roth IRA but have a high income? You might face income limits. But there’s a workaround called a backdoor Roth IRA conversion. Here’s how it works:

Earned Income: To start, you or your spouse need earned income. Even if one spouse isn’t earning, they can use the other’s income to contribute to their IRA.

Example: Jose’s still working at 75, and his wife isn’t. Using Jose’s income, they can each contribute to their IRAs and then convert to Roth IRAs.

Pro-Rata Rule: Be cautious of the pro-rata rule. When converting, if you have other traditional IRAs with both deductible and nondeductible funds, your conversion might be partially taxable.

Example: Grace makes a non-deductible contribution to a traditional IRA but has a SIMPLE IRA too. Her conversion will be partly taxable due to the pro-rata rule.

So, while the backdoor Roth IRA conversion can be a smart move for high earners, be mindful of these cautions to avoid unexpected tax implications.

Beyond Price: Nourishing Your Wealth and Future

Let’s talk about family wealth management. It’s not just about numbers and transactions; it’s about values and relationships.

In the media, there’s a lot of talk about whether financial planning and family wealth management is all about the price. Some suggest that the cheapest option is the best because all you need is a basic portfolio and no personalized service. But that’s like saying all you need for dinner is fast food.

We see things differently. We understand that each family is unique, with its own goals, dreams, and challenges. That’s why we offer personalized advice and services tailored to your specific needs.

Our approach is about more than just investments. It’s about building a long-term relationship that extends beyond the numbers to include your family and your future. We’re here to help you stay on track and avoid costly emotional decisions that can derail your financial goals.

So, while others may offer quick-service solutions, we believe in serving up a gourmet meal—a comprehensive plan that nourishes your financial health and empowers you to live your best life. Because when it comes to your wealth and your family’s future, value matters more than price.

Maximize Your Financial Management with Our Online Portal

Are you taking full advantage of your online portal? It’s a powerful tool at your fingertips. Here’s what it offers:

- Consolidated Financial Overview: Link external assets and liabilities to easily track all your finances in one centralized platform.

- Personalized Planning Tools: Tailored features to assist in your financial planning journey.

- Comprehensive Reporting: Access various reports related to your AWM accounts effortlessly.

- Data Collection Tools: Streamline your financial planning process with tools designed to gather relevant information.

- Secure Vault: Safely store and access AWM reports, upload documents for sharing, and maintain a private documents folder.

If you need help setting up your credentials, logging in, or navigating your online portal, please contact Debbie.

As the markets rise, so does the value of your retirement account. But with traditional IRAs or pre-tax 401(k)s, there’s a tax downside: Required Minimum Distributions (RMDs). Eventually, you will be forced to withdraw funds, leading to potential tax headaches. Here’s a few ways to potentially ease the tax burden:

- Qualified Charitable Distribution (QCD): Donate up to $105,000 annually from your IRA to charity tax-free, satisfying RMDs without tax implications.

- Still-Working Exception: If you’re working past 73, some company plans allow RMD delays until retirement, even for IRA funds rolled into the plan.

- Qualified Longevity Annuity Contract (QLAC): Invest in a QLAC to delay RMD calculations until age 85, reducing your annual distribution.

- Convert to Roth IRA: Convert to a Roth IRA to avoid lifetime RMDs, though conversion is taxable. But once converted, no more RMD worries.

Each method helps you avoid paying too much tax on your retirement savings, making sure your money stays where it belongs – in your pocket.

Looking Ahead: Proactive Planning for Your Financial Future

As we bid farewell to another tax season, it’s a fitting moment to shift our focus forward. My most successful clients recognize the value of planning and have peace of mind in knowing that they are taking care of their financial health.

While tax season may be behind us, the opportunity for strategic planning lies ahead. Don’t wait until the year’s end to assess and make crucial decisions. Now is the time to be proactive and set the groundwork for a prosperous retirement.

Whether it’s mapping out investment strategies, optimizing tax efficiency, or safeguarding your legacy, our team is here to guide you every step of the way. Remember, true wealth isn’t measured by how much you earn, but rather by how effectively you preserve and grow what you have.

Sincerely,

Petr Burunov, CFP®

President / Wealth Strategist