Ladies, Would You Like to Have an Extra $100k in Retirement?

Why You Should Care about More Money in Retirement

Money might not buy you happiness. However, money can make happiness last longer.

According to researchers led by Dr. Raj Chetty of Stanford University [source], the more wealth you have, the longer you are expected to live.[1] Possible reasons why wealthy people might live longer include:

- Lower death rates from substance abuse and violent crime

- Better access to health care

- Less psychological stress from financial issues

- Ability to afford living in a moderate climate

More Money Matters in Clark County, WA and Metro Portland, OR

People with greater income also tend to live longer in our local area of Metro Portland and Clark County.

Data compiled by Alvin Chang at vox.com [2] show that people in Clark County who earn above the median household income of the average family live anywhere from 3-8 years longer. The general trend also applies to metro Portland and the states of Washington and Oregon.

Women live on average a couple of years longer than men. Yet, the similar trend of higher income leading to longer life expectancy applies both to women and men.

Social Security: Case Study of One Major Decision That Can Impact Your Retirement

Your choice of when to retire could impact the rest of your life.

Social Security is a major component of funding your retirement.

Let us take a simple, hypothetical example of a single woman named Marge. She is currently working and has to decide when to retire. Marge is in pretty good health, so physically she has flexibility as to when to stop working.

Social Security Decision: When Should Marge Retire?

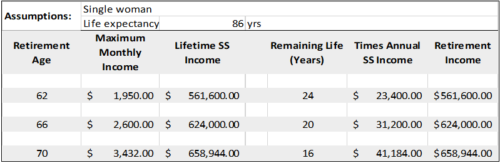

The table above highlights an important aspect of Marge’s decision. The later she retires, the more income she would earn over her expected life in retirement.

For instance, if Marge chose to retire early at age 62, she could earn Social Security income as much as $1,950 per month. Applying the median life expectancy for women in Clark County of 86 years old, Marge would enjoy 24 years of retirement. She would earn about $561,600 from Social Security during that time.

In contrast, if Marge chose to work another 8 years and retire at age 70, she could earn nearly $100,000 more in income during retirement. By waiting, Marge’s maximum monthly income would rise to $3,432. Her lifetime Social Security income would total $658,944. In other words, Marge could earn $97,344 in higher income simply by waiting a little longer to retire.

Is $100k more in retirement worth waiting for?

How We Can Help You Navigate the Complexities of Retirement

Marge’s case study includes many simplified assumptions. As a matter of fact, Social Security, and retirement, in general, are quite complex issues for many people. Realistically, what might apply to people similar to Marge might not necessarily apply to your specific situation.

However, we have worked with many different people, both individuals and families, who face the same questions. While you face complexity in life, our job is to help you simplify life and navigate through these issues. Let us also not forget that your real goal in retirement is to celebrate life. We would love the opportunity to hear your unique story and work together with you.

[1] Raj Chetty, Ph.D., Michael Stepner, BA, Sarah Abraham, BA, et.al., “The Association Between Income and Life Expectancy in the United States, 2001-2014”, April 26, 2016, on https://jamanetwork.com/journals/jama/article-abstract/2513561 accessed on June 29, 2018.

[2] Interactive Chart in Julia Belluz and Alvin Chang, “What research on English dukes can teach us about why the rich live longer”, July 27, 2016, on https://www.vox.com/2016/4/25/11501370/health-longevity-inequality-life-expectancy accessed on June 29, 2018.