Investment Newsletter 1Q18

Your Investments and Ambassador Wealth:

Cautiously Optimistic in 2018

Stuart P. Quint III, CFA

Managing Director – Investments and Compliance

- Ambassador Wealth remains cautiously optimistic heading into 2018.

- Why we are optimistic – and why we are cautious

- Where your portfolios are invested – and where they are not

Investors in risky assets had a jolly good year in 2017. The S&P 500 gained nearly 20%.

Even with the fanfare over FANG stocks, other risk assets performed well.

Asset Category |

Total Return in 2017 |

| S&P 500 | +21.8% |

| Russel 2000 (US Small Cap Stocks) | +13.1% |

| MSCI EAFE (International Developed Equities) | +25.1% |

| MSCI EM Free (International Emerging Markets) | +40.3 |

| GSCI Commodity Index (Commodities) | +7.6% |

| Barclay Aggregate (Fixed Income) | +3.3% |

| Barclays High Yield (High Yield Corporate) | +5.8% |

Entering 2018, Ambassador is taking a cautiously optimistic stance with regard to portfolios. We think positive gains in many areas are still possible. However, we are also mindful of risks and would not be surprised to see a mild correction at some point. Let us explain.

Why are we still optimistic?

- Corporate profits are still healthy.

- Monetary policy is still accommodative.

- Global growth is broadening beyond the US.

- US tax reform helps economic growth (at least temporarily).

- Technological innovation (US leads the world in this area)

Why are we only cautiously optimistic (instead of all-out bullish)?

- Last year’s strong markets might be hard to repeat this year

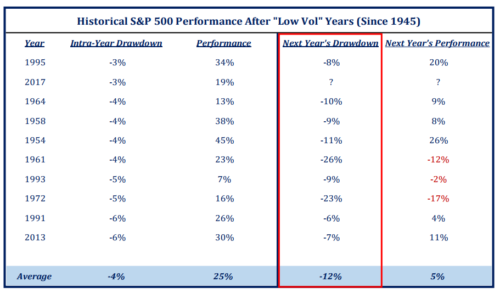

- Technical – Strong gains of the previous year historically have not repeated in the following year.

That does not necessarily have to mean disaster. According to data studied by Strategas Research, 6 out of 9 years still resulted in positive market gains. Nonetheless, corrections are possible even if the bull market were to persist.

- Valuation – The US market appears richly valued relative to history over the last 50 years (although nowhere near the peak of 1999-2000). Corporate profits need to remain strong to justify current levels. Near term, it is hard to see significant profit erosion without an economic recession.

2. Pressures on US corporate margins

- Corporate profit margins are still close to historic highs, helped in part by pricing power and low cost of debt. Productivity will engage in a “tug of war” between rising wage pressures and productivity gains from technological innovation. With the Fed seeking to raise rates, debt costs have potential to rise. However, so long as economic growth remains moderately positive, though, shrinkage in profit margins might be limited.

3. Midterm congressional elections potentially pose risk to the US market outlook. The possibility exists that the Democrats might take over both houses of Congress. Democratic Congresses and Republican Presidents historically have resulted in muted returns for markets.

4. The Fed (and other central banks) might continue to raise interest rates. Tighter monetary policy might contribute to higher volatility and lower returns. Markets have rallied in part to the stability of growth and inflation experienced over recent years. Any change in that stability might disappoint markets.

- Risk to upset Goldilocks of low volatility (inflation, growth, credit)

5. Overseas risks (in descending order of concern for us): Europe (Italian election results possibly could lead to calls for withdrawal from EU), China growth (tighter monetary and structural policy could squeeze growth for China, the world’s largest economy), geopolitical (populism, North Korea)

What we like:

- Cautiously optimistic on equities (still cheaper than fixed income)

- Broader exposure beyond S&P (small cap, Japan, emerging markets)

- Liquid absolute return strategies less correlated to equities or fixed income (call writing)

What we dislike:

- Much of fixed income (duration, most credit pricey)

- Europe

- Many illiquid “alternative” strategies

We wish you the best in 2018 and look forward to giving you more communication on your portfolios. You will see more short blogs in the future. You will see more detail as to how we think about the world in seeking to benefit your investments. These blogs will come in addition to the quarterly articles you will receive with future statements.