Investment Update: September 2022

- AWM has diversified your investments beyond just traditional stocks and bonds.

- Introduction to the newest strategy in your portfolio (it’s not fixed income)

- Opportunities for other positions in your “diversified” sleeve

“Don’t put all your eggs in one basket.”

2022 has been a good illustration of this saying for investors. Both stocks and bonds declined.

It is true that, over the long term, stocks can appreciate from earnings growth, dividends paid, and price expansion.

That does not mean that stocks go up each and every year, especially when valuations are high and interest rates are rising (like now). There are times to load up – and times to lighten up.

Currently, bonds that earn less than inflation won’t help investors achieve their objectives to grow and defend principal. (Until these conditions change, you are unlikely to see a lot of fixed income in your portfolio.)

Hence, we have committed a lot of resources and time to seeking other diversified investments. We are very selective about what you own. It is arduous to separate the wheat (tenured managers with success that has the potential to repeat for current or new investors) from the chaff (most hedge funds and REITs do not deliver and simply charge expensive fees).

We also demand that they are liquid (you can invest or take money out any working day of the week) and transparent (daily pricing by a reliable third party).

This short blog will tell you a little how your “diversified” investment bucket might help your portfolio.

Introducing a New Strategy to Your Portfolio

In our last newsletter, we mentioned our caution on traditional fixed income. Rates and credit risk were not enough to compensate for inflation and other risk. Consequently, cash balances in your account were high.

Recently, we added a new investment strategy that potentially provides some of the positive characteristics of traditional fixed income with potentially lower risk. This is called “merger arbitrage”. When an acquiring company (or private equity) announces it will buy a target company, it requires time and regulatory approval before the deal is completed. The current price of the target company does not fully reflect the acquisition until the deal is completed.

Such a discount creates opportunity for merger arbitrage funds to make money. Presuming their due diligence on the deal going through is correct, they earn returns by buying the shares of the target company and hedging market risk by selling (going short) of the acquiring company.

The potential benefits to investors might include: (1) steady, positive returns over time, and (2) limited equity market risk due to hedging. Possible risks include deals falling through and drastic reduction in the opportunity set of deals in which to invest.

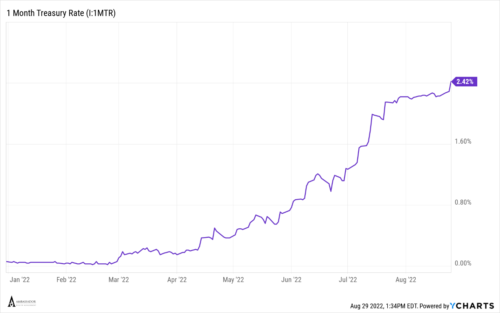

Merger arbitrage also has the potential to benefit if interest rates continue to rise, since they can generate higher income on cash invested in deals. In that sense, merger arb resembles a short duration bond strategy, perhaps with higher potential returns. (In contrast, many parts of traditional fixed income might be hurt by higher rates; investors might sell high duration and credit risk in favor of a higher, safer yield on money market assets.)

Seeking to Make Money in Rising and Falling Stocks?

Another manager in your diversified sleeve is an equity long-short strategy. (This fund is closed to new investors and can only be accessed through select advisors like us.) The manager invests in securities with solid businesses and cheap valuations on the “long” side while hedging by selling stocks with poor fundamentals and expensive valuations on the “short” side.

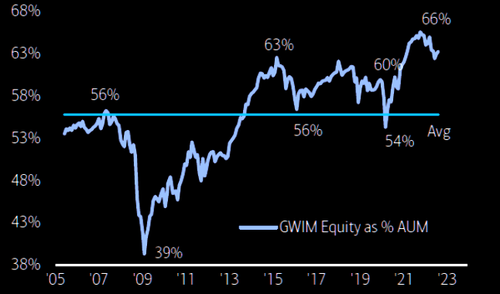

The chart below suggests that most managers have reduced or given up investing in falling stock prices for the average stock in the S&P 500. Less competition might open more opportunity for managers that seek to make returns in part through falling share prices.

We remain cautious on most traditional assets. Since the market rebound from the June lows, sentiment has grown too optimistic. While bears talk at cocktail parties and AAII sentiment surveys, they are not putting their money where their mouth is. For example, the average investor at Bank of America still has very high exposure to stocks (measured as stock allocation as a percentage of total investments).

Indeed, it is close to the all-time high only a few months ago and well above average levels from 2009.

Commodity Investments Ride the Inflation Wave

Your portfolio might also include shares in commodities, including an active mutual fund manager and passive exchange-traded strategies. Supply constraints and concerns of a weaker dollar might continue to push prices upward over time. Risks of lower demand from slower economies also exist.

You can read more about our thoughts on commodities here and here .

Conclusion

In bull markets, people typically focus on returns over risk. But when the markets change, they are reminded that risk still exists.

Let’s be clear. No one (we ourselves included) can promise you a portfolio without any risk. It is impossible.

Even getting out of bed in the morning entails risk (you could fall, for instance). But you do it because most of the time, something good happens. Even when bad things do occur, the good far outweighs the bad over time. (Staying in bed all day also entails risk to your health.)

What we seek to do, however, is to take prudent risks. Not all risk is created equally. Not all risk is equally likely to happen or incurs damage to your portfolio.

That is why you will see a number of investments of your portfolios, including a chunk in what we call the “diversified” bucket.

If you know someone whose nest egg has been beaten up in the market and needs help to stabilize things, please let us know. We are here to help.