Investments 101: Inflation and Bonds: Toast of the Town or Simply Toast?

Bonds have treated investors very well for the last two decades. Inflation has been hard to find.

Is this about to change?

Up until this year, long-term US Treasury yields were the “toast of the town” for a long while. Going back three decades, bond yields, for the most part, have declined (and prices have risen). Bond yields touched new multi-decade lows even after the trough of the Great Recession in 2008.

Have bond investors enjoyed too much of a good thing?

Today, bond yields appear too low, even if inflation behaves. If inflation were to rear its ugly head, then bonds could be “toast”.

Let us see why.

“Real” vs. “Nominal” Bond Yields

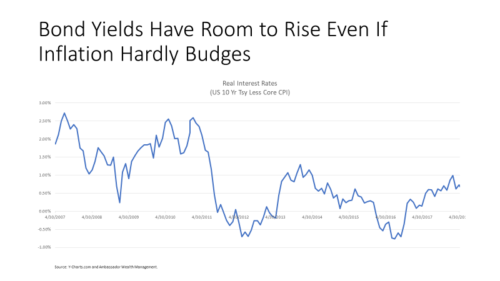

The chart above examines yields on US Treasury bonds maturing in 10 years – with a twist.

Traditional charts display prices in nominal terms. For example, an investor buying a US Treasury Bond with the intent to hold it to maturity in 10 years, the investor would receive interest of around 3.1% per year. (Of course, this does not take into account any fluctuations in price from market volatility. This is why bond investors should focus on total return, price return plus yield, and not just yield.)

However, many bond investors also look at bonds in terms of real returns. Real returns consider how the income an investor receives tomorrow is impacted by the prices that investor will pay to support his or her lifestyle (or fund someone else’s liability). In other words, take the nominal yield and subtract annual inflation to calculate the bond yield in real terms.

The chart above shows yields on US Treasury bonds with maturities of 10 years in real terms. (Sometimes, this presentation of bond yields is referred to as “real bond yields”.) The rate of annual inflation is “core inflation” excluding food and energy. This index is published monthly by the US Bureau of Labor Statistics.

Nominal yields have risen from roughly 2.5% last summer to 3.1%. Yet, when we look at bond yields in real terms, the increase appears quite modest (and yields quite low), even compared to recent history.

Currently, real yields are at 0.6%. In other words, investing in the 10-Year Treasury would yield an investor income growing 0.6% above inflation (assuming it stayed constant). That seems low.

Only 7 years ago in 2010, investors could have earned real yields as high as 2.5% above inflation. That was a time where the Fed was not hiking interest rates. Markets worried about the duration and sustainability of economic growth. (Even some questioned whether the US was really in as bad shape as Japan 2 decades ago.)

Today is a different story. The Fed is entering its third year of tightening. The economy is entering the second longest duration of recovery in recorded US history. (Of course, the size of the recovery is also weak by historical standards.) Inflation might also be ticking upward (and certainly not negative, which was the fear only 7 years ago).

What is the conclusion? Real bond yields might potentially have room to move up, even if we just look at recent history. Even if core inflation stays tame, simply the premium on nominal yields to inflation could simply rise toward 2.5% from current levels. Keep in mind that the Fed has begun to shed some of the bonds it bought in earlier, multiple bond-buying sprees of Quantitative Easing less than a decade ago.

If inflation ticked upward, that could put additional pressure on long-duration bonds.

Bond investors might be in for interesting times ahead…

Let us help your family to navigate through this challenging environment.