Your House: Low Supply Has Inflated Prices in Portland/Clark County (Part Two)

Home Supply in the US Is Low by Historical Standards

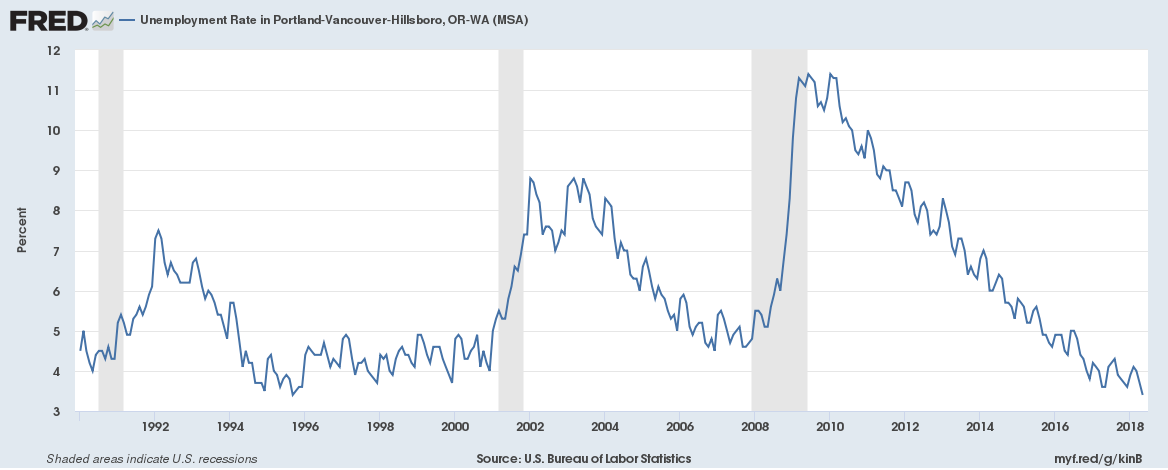

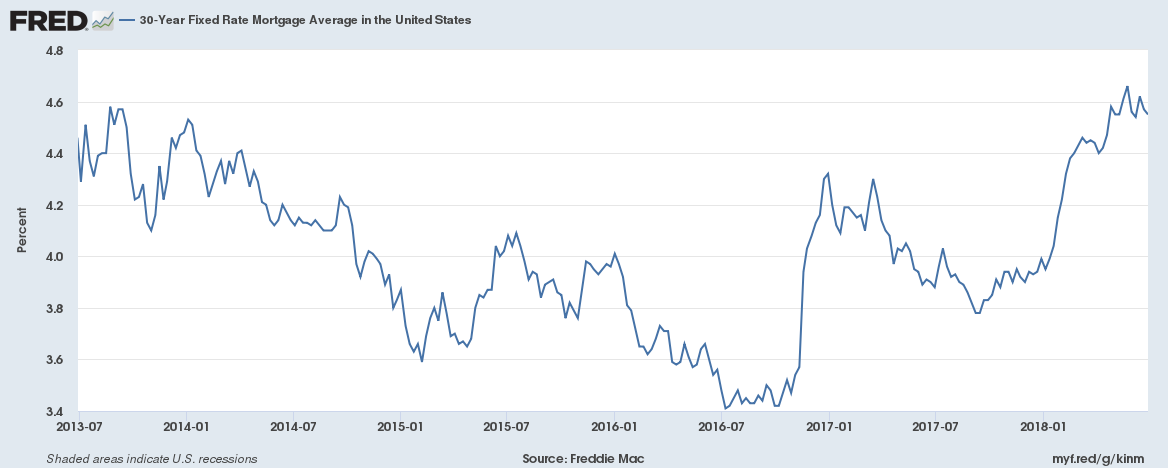

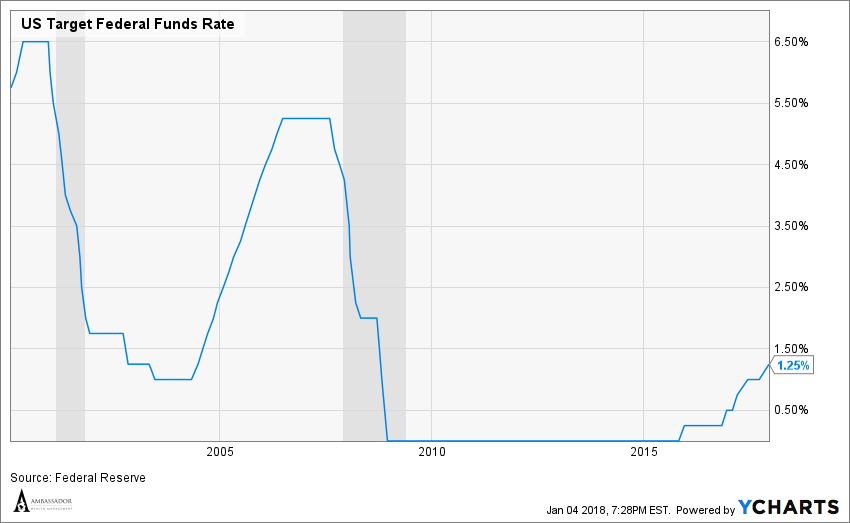

Why have home prices recovered so strongly? Are these factors sustainable? What might this mean for the value of one’s property?

The limited supply of housing (new and existing) has been a major support for the housing recovery. Lack of new home starts and high home occupancy by both renters and owners have contributed toward rapid turnover in homes listed for sale.

Inventory of homes across the US appears low by historical standards. At the current rate of sales, the average home potentially sells 6 months after its initial listing. Supply of homes is above the trough of 4 months in the early 2000’s during the housing bubble. However, inventories still are on the low end of the historic range over the last 50 years and have been stable at around 5-6 months since 2012.

Retrieved on June 28, 2018.

Limited supply is also reflected in low levels of vacancies on owned homes and rising occupancy in rentals. The slight recent uptick in rental vacancies reflects an increase in supply in certain markets as a response to recent market tightness and rising rents. Nonetheless, both owned and rental vacancies remain toward the low end of recent historical ranges. Finding a home can be a challenge.

Supply of New Homes Recovering but Below Prior Peaks

The amount of new homes being built is still lower than historical averages. Although new home starts have recovered from their trough in 2010, the number of new homes built still lies at the lower end of historical economic expansions. The current rate of 1.3 million units compares with the historical midpoint of 1.6 million units over the last 50 years.

Similar trends apply to our region. The Oregon Office of Economic Analysis also forecasts home starts to peak next year. Current rates are still well below peaks in the last 2 cycles.

https://ycharts.com/indicators/oregon_housing_starts accessed on June 28, 2018.

Workers Are Returning to Home Construction

Tighter credit coupled with an exodus of workers from residential construction have dampened recovery in new housing starts compared to past cycles.

Workers in construction jobs are still below the prior peak by about 4% in spite of the robust recovery in home prices. However, growth in labor supply of construction workers along with other economic factors might temper future home price gains in the future.

Retrieved June 28, 2018.

Learn about the looming risks of housing in metro Portland/Clark County WA.