Investment Newsletter 4Q19

Investment Newsletter 4th Quarter 2019

US Recession: To Be or Not to Be? That Is the Question!

Brief Investment Update

On the macro side, not a lot has changed from our last newsletter. The US economy looks relatively better than the Rest of the World. Global growth in general is tepid to challenged.

Controversy swirls over whether the US will join the rest of the world in negative economic growth soon. Reasonable arguments could be made in either case, though current data goes against the case for recession.

Indeed, current numbers suggest weak but continued positive growth. Consumption has been solid, and jobs growth has been positive, albeit decelerating.

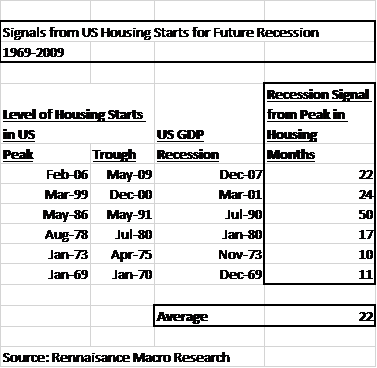

Housing has resumed its growth from last year. Housing starts hit a new cyclical peak in August.

If trends of the last 50 years were consistent with today, that might suggest recession could be at least 2 years away. That also assumes that housing starts have already peaked for this economic cycle (which might or might not be the case).

One of the main arguments for a future US recession is vulnerability in manufacturing. Non-residential construction has been weak. Exports have been languid due in part to the trade war (our best guess: de-escalation but no trade deal soon) and also lack of overseas demand.

Growth in major economies such as China, Germany, Japan, India, and the UK is sluggish to negative. Global growth is likely to weigh on profits for US companies with large overseas businesses.

On the flip side, there have been all kinds of interest rate cuts and liquidity bolstering measures overseas. The US has gradually followed suit with 2 interest rate cuts of 25 basis points each to the Fed Funds rate. The yield curve remains inverted.

How Might This Influence Your Investments?

Based on your objectives and risk tolerance, your investment portfolios generally retain a neutral to cautiously optimistic tilt. We see a balance of opportunities and risks, which is reflected in diversifying the positions in your portfolio.

Certain of your investments have done very well (especially broad large domestic equity exposure and generic high-quality bonds). Other investments have trodden water in the last 2 years, particularly active managers in small cap and long-short equity. These active managers tend to favor diversification and investments with good fundamentals at reasonable valuations. For the reasons cited later, active managers have not participated as much in the rally over the last couple of years.

However, these laggards might be starting to show signs of life. If they were to continue to recover, this could help meaningful portions of many portfolios.

In spite of the market’s flattish performance over the last 12 months, we have seen some significant anomalies develop. Pockets of potentially overhyped momentum and overvaluation have emerged. Other areas appear to have been “left for dead” by investors.

One example is “growth” vs. “value”. Growth stocks have higher valuation measures anticipating higher future earnings growth (or even ignoring negative earnings). Growth stocks have risen far more than value stocks with lower valuation and lower implied growth expectations.

The chart below shows performance from 2017 to 2019 of US small cap stocks by deciles of profitability and valuation. Bars to the right indicate the most expensive stocks with the lowest levels of current profits. Bars to the left show companies with cheaper valuations.

The chart below suggests that extremes in performance between “growth” and “value” might not persist forever. Sharp outperformance in growth is often followed by a reversion back to historical averages. Such trends might reward those who look for quality assets at reasonable, not just any, prices.

We will adjust your portfolios as we monitor trends in markets and the global economy.

Thank you,

Stuart P. Quint, III, CFA

Director of Investments and Compliance