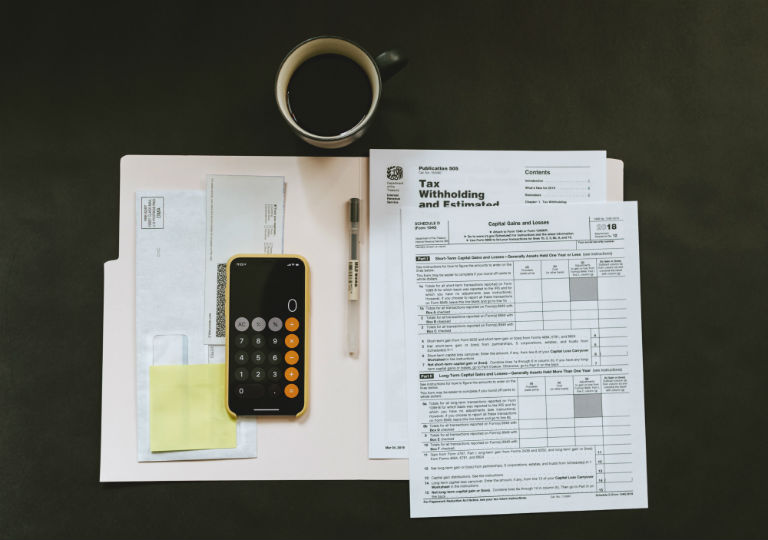

How Can I Prepare For Tax Season?

Ready, set, tax season is already well underway! Are you prepared? It can be an overwhelming process of gathering documents, filling out forms, and paying money to Uncle Sam. To make things easier, here are five tips to help you prepare for filing your taxes: Review your W-4 Annually. Understand how your W-4 can Read more ➝

Don’t Wait to Start Your Year-End Financial Planning

August tends to be “nap-time” for most Americans. Work at the office might not be as busy, families are slowly making their way home from vacations, and kids are getting ready to head back to school. This makes August a stellar time to work on your finances. My advice? Don’t put it off until December. Read more ➝

Should You Pay Someone to Do Your Taxes?

Filing your taxes can be complicated and overwhelming. You know the process—gathering paperwork, sorting through receipts, and crunching the numbers. Thankfully, there are a few ways to make this whole process easier. Consider if hiring a professional is a better option than filing your tax return yourself. Hiring a Pro: The bad news? You still Read more ➝

Not All Investment Income Is Created Equal Because of Taxes: Case Studies

Earlier, we discussed how the 3 types of investment income can have a big impact on your taxes. Your knowledge or ignorance of these issues can have a major effect on your standard of living. How? Let us take a look. Why the real income you make comes after taxes come out Taxes are a Read more ➝

Not All Income Is Equal Because of Taxes: 3 Types of Income

The Declaration of Independence declares that all people are created equal. That is not true about income coming from investments. Many of your neighbors forget this fact to their detriment. One of the major problems people often do not understand is taxes. You can reduce different types of income with different levels of taxation. Be Read more ➝

Gifting Might Be a Viable Strategy to Limit Taxes

Doing good to others can also mean doing well for yourself. Charitable giving potentially offers a key component toward managing one’s nest egg. (Check out the IRS’s Tax Exempt Organization Search tool to make sure your charity is qualified to give you a tax deduction on your donation.) You have the opportunity to donate toward Read more ➝

3 Ways Reaching for Income Can Make You Broke

Many people need additional sources of income. This need becomes acute as people enter retirement. Precisely where people have the greatest need is also when they are most vulnerable to misunderstanding. Making mistakes with income risks lowering your future standard of living. We continuously run into clients who seek income, but who have misunderstood what Read more ➝